lincoln ne sales tax rate 2018

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Sales tax region name.

There is no applicable county tax or special tax.

. There is no applicable city tax or special tax. The local sales and use tax rate in Chadron will increase from 15 to 2. Taxation of the Cornhusker State of Nebraska has a 5 percent sales tax.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates. When the city of Arapahoe goes into effect in April 2022 it will raise. There are sales tax rates for each state county and city here.

One percent one percent one percent. 1 the Village of Orchard will start a 15 local sales and use tax. Local governments can also impose a 2 local option sales tax.

Lincoln Nebraska has a sales tax rate. 800-742-7474 NE and IA. There is no applicable special tax.

You can print a 8 sales tax table here. The Nebraska state sales and use tax rate is 55 055. The Nebraska sales tax rate is currently.

Society of lancaster co. In cities and counties the proportion of labor costs is 75 and 2 respectively. Local sales and use tax rate changes have been announced for Nebraska effective October 1 2015.

Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500. There is a 5 percent state sales and use tax in Nebraska. The Lincoln City sales tax rate is NA.

Tax rates last updated in March 2022. 025 lower than the maximum sales tax in NE. In Lincoln Nebraska all taxes will be equalized by a combined 744 starting in 2021.

Did South Dakota v. Historical Sales Tax Rates for Lincoln 2022 2021 2020 2019 2018 2017. State county and city sales tax rates are included in this equation.

For tax rates in other cities see Washington sales taxes by city and county. Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65 Sales and Use Tax Rate Cards Form 7 Sales and Use Tax Rate Cards Form 725 Sales and Use Tax Rate Cards Form 75 Sales and Use Tax Rate Cards Form Nebraska Application for. Historical Sales Tax Rates for Lincoln 2022 2021 2020 2019 2018 2017.

The December 2020 total local sales tax rate was also 5500. The 85 sales tax rate in Lincoln consists of 65 Kansas state sales tax 1 Lincoln County sales tax and 1 Lincoln tax. 201415 201718 201819 201920 1 yr 5 yr tax rates for taxpayers rate rate rate rate change change inside lincoln city limits agric.

Nebraska Sales Tax Rate Finder. Wayfair Inc affect Nebraska. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton.

What Is Nebraska Sales Tax Rate. In Lincoln the local sales and use tax rate will jump from 15 to 175. Select the Nebraska city from the list of popular cities below to see its current sales tax rate.

The Agreement became effective on October 1 2005. The County sales tax rate is. On July 1 2005 at a meeting of the Petitioning States Nebraska was unanimously voted a full member of the Streamlined Sales and Use Tax Agreement after having met all of the requirements for membership in this Agreement.

You can print a 725 sales tax table here. There is no applicable special tax. With local taxes the total sales tax rate is between 5500 and 8000.

The sales tax jurisdiction name is Lincoln Center which may refer to a local government division. The 2018 United States Supreme Court decision in South Dakota v. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

There is no applicable special tax. 1 2020 Deshler will collect a new 1 sales and use tax while Unadilla will collect a new 15. For tax rates in other cities see Alabama sales taxes by city and county.

During 2018 there were 295 local tax jurisdictions in the state that collected a total of 0000 in average local taxes. A 0 percent local sales tax and a 0 use tax can also be imposed. There is 0 additional tax districts that applies to some areas geographically within Lincoln City.

The Lincoln sales tax rate is. Nebraska has recent rate changes Thu Jul 01 2021. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit.

Lincoln Ne Sales Tax Rate 2018 Agustus 05 2021 Dapatkan link. In Nebraska what are the sales and use tax rates. For tax rates in other cities see Nebraska sales taxes by city and county.

Nebraska Department of Revenue. The 8 sales tax rate in Lincoln consists of 65 Washington state sales tax and 15 Lincoln County sales tax. Current Local Sales and Use Tax Rates and Other Sales and Use Tax.

Nebraskas sales and use taxes are five percent. A total of 7 per cent of Lincoln Nebraskas total sales taxes is required in 2021. Streamlined Sales Tax Central Registration System.

You can print a 10 sales tax table here. Does the sales tax rate look like a sales tax rate in Lincoln Nebraska. Lincoln Ne Sales Tax Rate 2018 Agustus 05 2021 2018 rate sales 0.

The additional tax rate will begin in October because of the timelines set by the state and will bring the city sales tax to 175 percent for the next six years. The 2018 United States Supreme Court decision in South Dakota v. Has impacted many state nexus laws and sales tax collection requirements.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The minimum combined 2021 sales tax rate for Lincoln Nebraska is. The 10 sales tax rate in Lincoln consists of 4 Alabama state sales tax 1 Talladega County sales tax and 5 Lincoln tax.

Does Nebraska Have Local Sales Tax. 0001516 0001409 0001391 0001347-316 -1115 airport authority 0000000 0000000 0000000 0000000 na na.

Gross Receipts Location Code And Tax Rate Map Governments

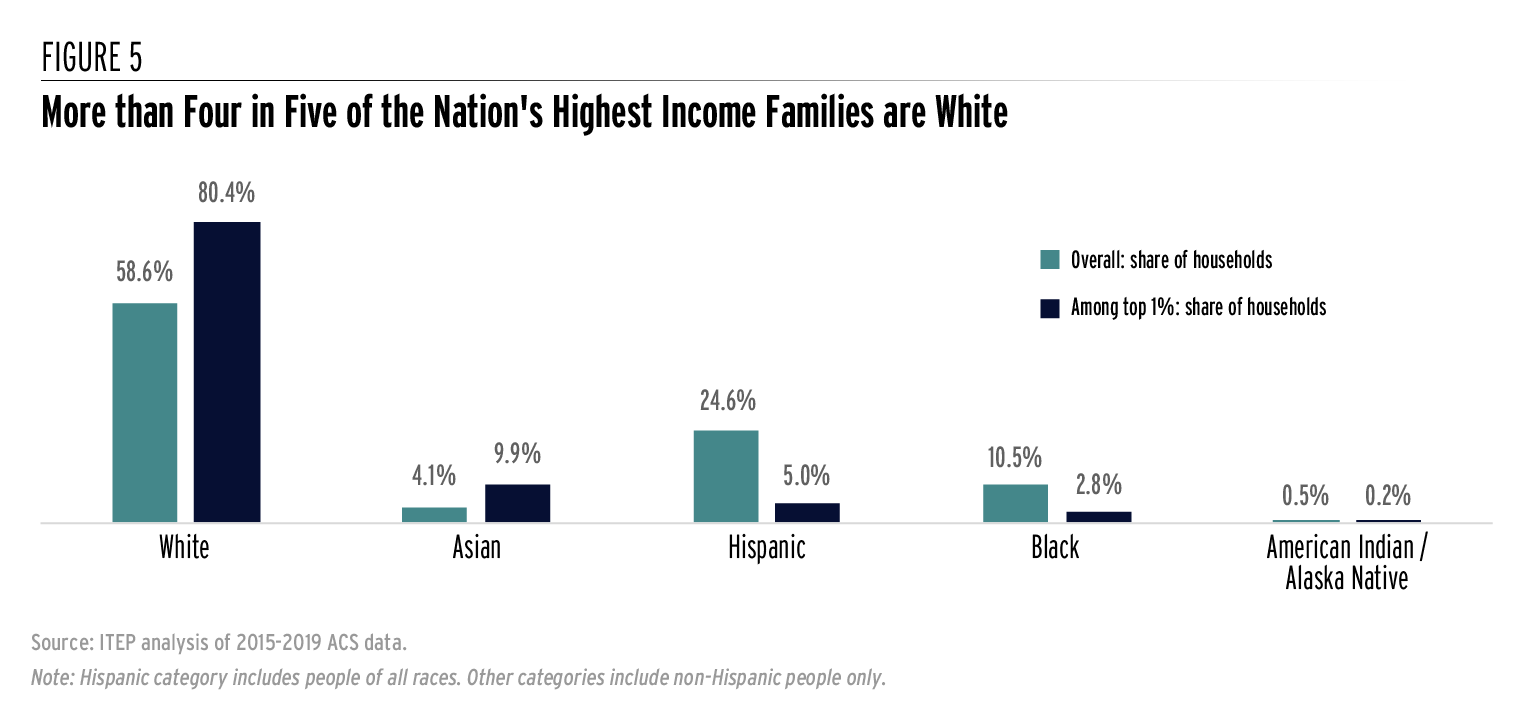

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Corporate Tax In The United States Wikiwand

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Pdf Tax System Change And The Impact Of Tax Research

Sales Tax On Cars And Vehicles In Nebraska

Corporate Tax In The United States Wikiwand

Corporate Tax In The United States Wikiwand

Pdf Tax System Change And The Impact Of Tax Research

Why Households Need 300 000 To Live A Middle Class Lifestyle

General Fund Receipts Nebraska Department Of Revenue

Corporate Tax In The United States Wikiwand

Why Households Need 300 000 To Live A Middle Class Lifestyle