pros and cons list carbon tax

A carbon tax aims to make retail corporates pay the full cost of carbon pollution. Theres really no enforcement mechanism.

The News Project Pros And Cons Of Carbon Tax Youtube

The system needs to be employed by law similar to other sin taxes on alcohol.

. As part of Canadas effort to meet its commitment. Companies have an incentive to go green as well. Published 15 November 2018.

If you give a company or. Pressure for a faster energy. Of course the tax is proposed to increase steadily but how much per year is not stated.

More and more fleet managers in the public sector are. List of Pros of Carbon Tax. Good for the Environment Carbon tax makes companies more responsible.

Let us explore the carbon tax pros and cons. Advantages of the Carbon Tax. The debate for a carbon tax is a unique topic of interest as it unites people on the political left and right yet the requirement for such a.

Carbon taxes have clear enforcement mechanisms companies have to pay their taxes. At a high level the primary advantage is the carbon tax will force companies to find alternative methods in their. The Pros and Cons of Carbon Taxes and Cap-and-Trade Systems.

If the carbon tax grows let us say by 20ton annually thus to 240ton in 10 years. In theory the tax will reduce pollution encourage more environmentally friendly alternatives. There are quite a few pros and cons that need to be discussed.

The carbon tax is the most equitable method for carbon use to pay for its pollution. The Pros and Cons of Using Renewable Diesel for your Government Fleet Posted 2020-12-13 December 13 2020. A cap-and-trade policy allocating tradable permits under a market price or a hybrid combination of carbon tax and cap-and-trade is best when the negative impacts could be high.

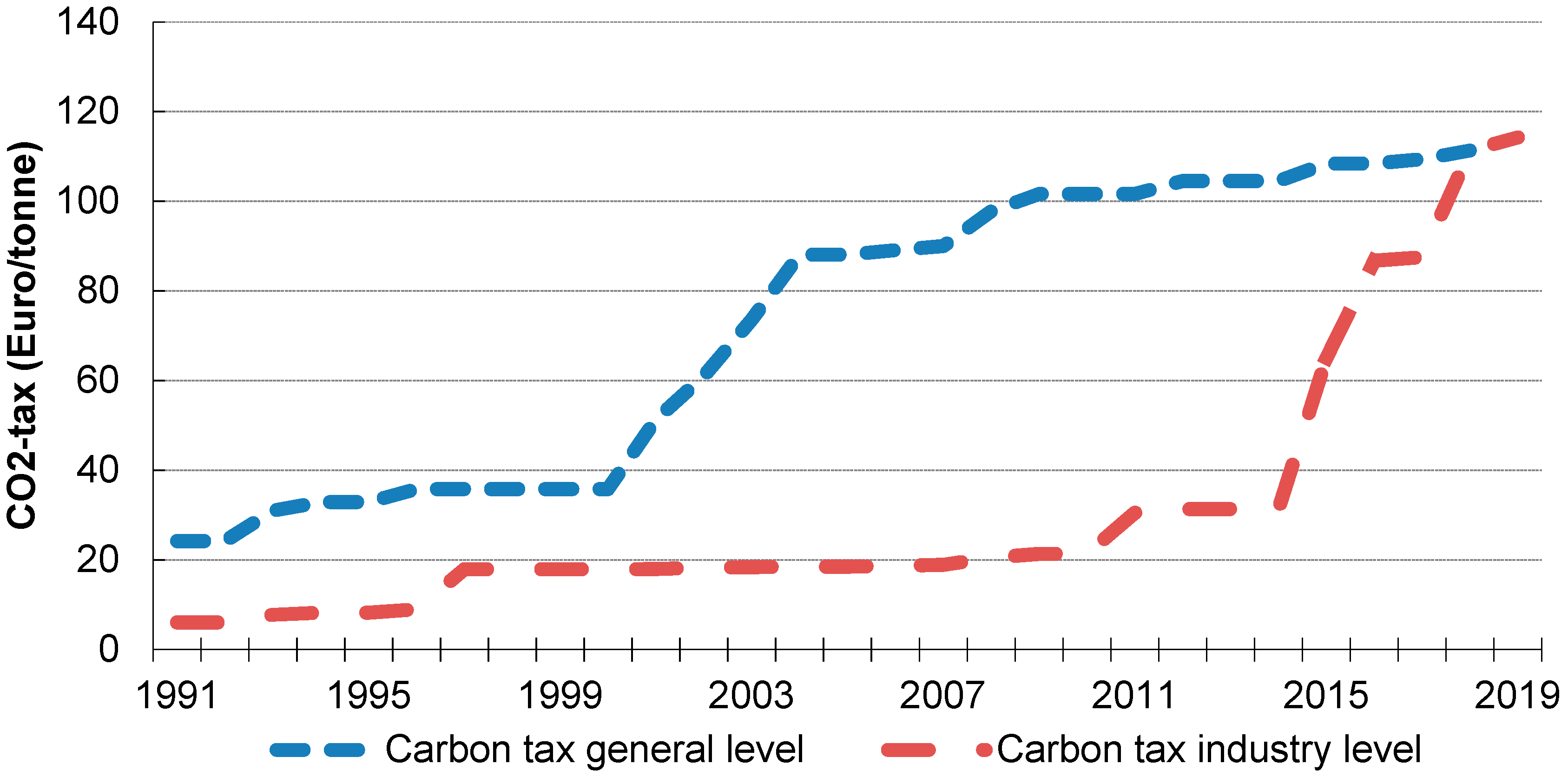

Carbon pricing is a method that assesses the external costs associated with greenhouse gas GHG emissions and connects those costs to the sources through a price on. From the religious and political. Instituting a carbon tax could help reduce the deficit and produce incremental benefits for the environment but could also raise the cost of many goods and services the.

Higher incentive for people to avoid the use of fossil fuels. The Pros And Cons Of Implementing Carbon Tax Lately there has been a great deal of discussion about the possibility of implementing a carbon dioxide tax. Carbon tax comes with its pros and cons.

The Role Of Carbon Capture And Utilization Carbon Capture And Storage And Biomass To Enable A Net Zero Co2 Emissions Chemical Industry Industrial Engineering Chemistry Research

What Are The Pros And Cons Of A Carbon Tax Elawtalk Com

Pros And Cons Of Working From Home Is It Better For You And Your Wallet Mintlife Blog

What Are The Pros And Cons Of A Carbon Tax Elawtalk Com

Carbon Tax What Are The Pros And Cons Climateaction

Summary Of Qualitative Assessment Major Pros And Cons Of Different Download Table

The 3 Biggest Advantages Of Renewable Energy And The Cons

Putting A Price On Emissions What Are The Prospects For Carbon Pricing In Germany Clean Energy Wire

William Nordhaus Versus The United Nations On Climate Change Economics Econlib

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Cbo Scopes Out Pros And Cons Of A Carbon Tax

Sustainability Free Full Text Carbon Taxation A Tale Of Three Countries Html

Solar Energy Pros And Cons Top Benefits And Drawbacks

Carbon Tax What Are The Pros And Cons Climateaction

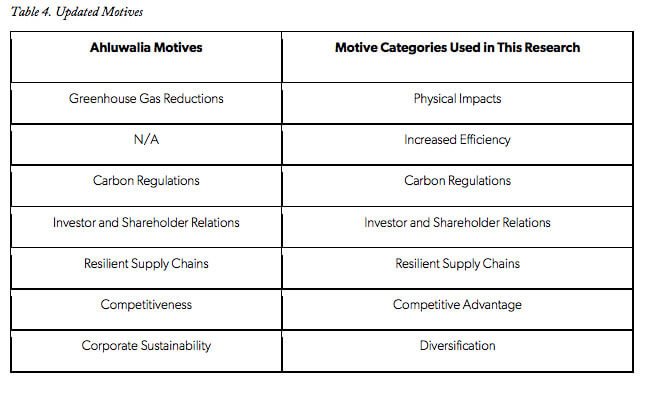

Carbon Pricing In The Private Sector The Cgo

Hooray For Carbon Taxes Mother Jones