santa clara county property tax rate

Learn more about SCC DTAC Property Tax Payment App. Idahos median income is 53517 per year so the.

Two Family - 2 Single Family Units.

. Demographics of Cases and Deaths Provides information on characteristics and demographics of COVID-19 cases and deaths including. Cook County collects on average 138 of a propertys assessed fair market value as property tax. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

The median property tax in Idaho is 069 of a propertys assesed fair market value as property tax per year. Census Bureau American Community Survey ACS 5-Year Estimates population estimates. It also performs the extension of the annual tax roll in accordance with the California Revenue and Taxation Code 260.

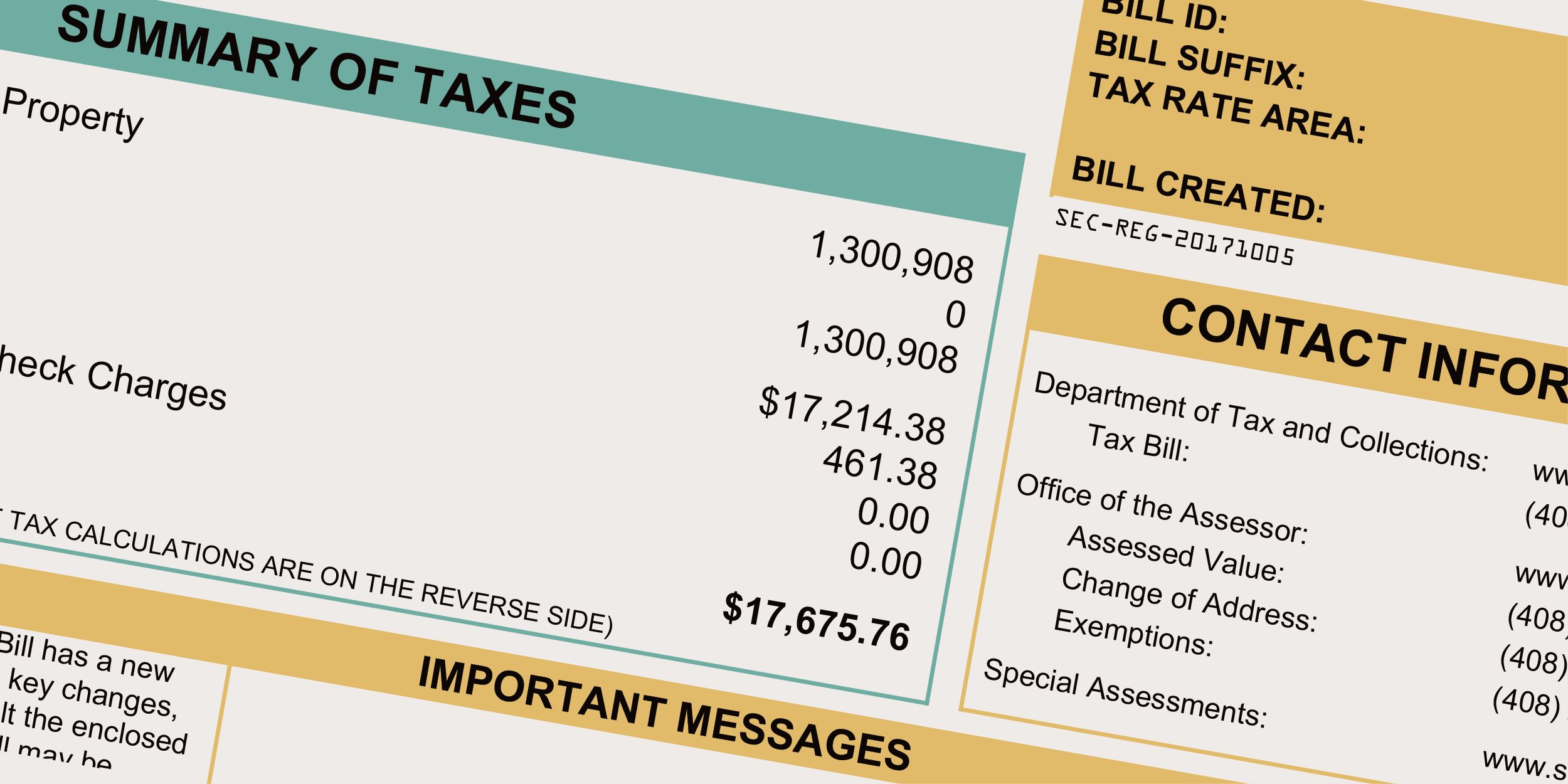

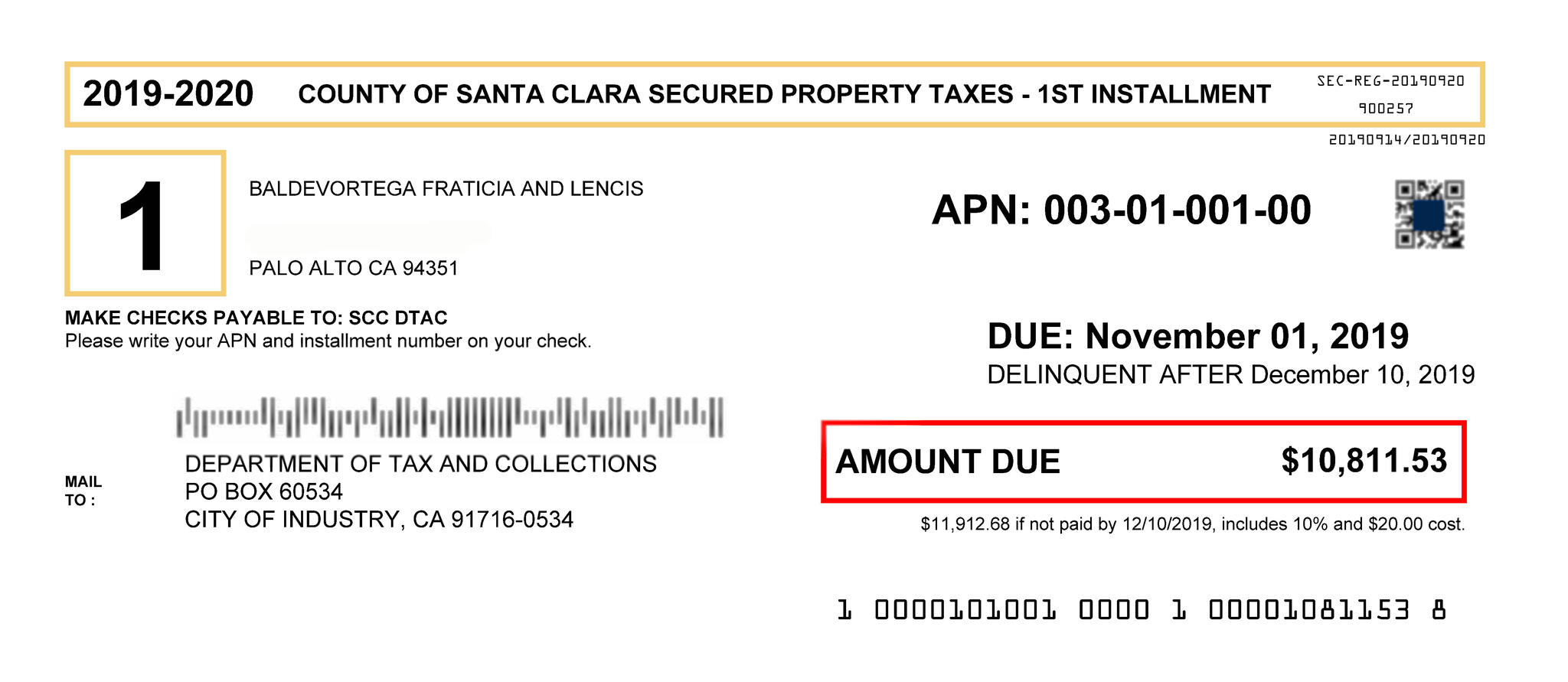

The property tax rate in the county is 078. Santa Clara County Property Tax Search Santa Cruz County Property Tax Search Shasta County Property Tax Search Solano County Property Tax Search. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500000 property owners with convenient access to pay their secured property tax payments.

The median annual property tax payment in Santa Clara County is 6650. All of the Countys COVID-19 dashboards have transitioned to using the US. This dashboard shows the 7-day daily average COVID-19 case rate by day for Santa Clara County overall for unvaccinated residents and for fully vaccinated residents.

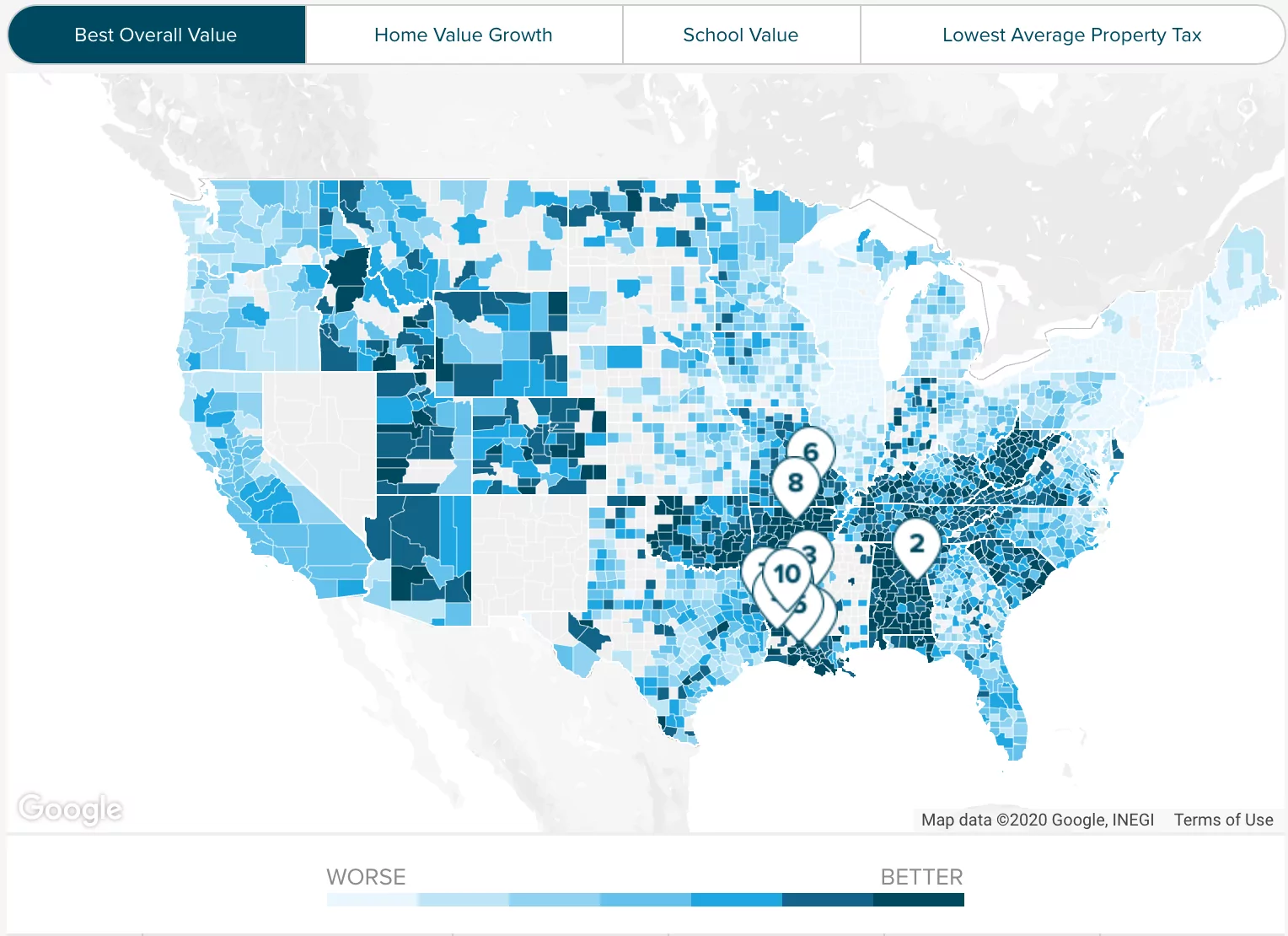

Idaho has one of the lowest median property tax rates in the United States with only thirteen states collecting a lower median property tax than Idaho. Annual Secured Property Tax Bill The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. Two Family - 2 Single Family Units.

Tax amount varies by county. The Department allocates and distributes property taxes accurately and timely to taxing entities including the County school districts cities and special districts. Adjusted Annual Secured Property Tax Bill.

Total tax rate Property tax. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year. Situated on the eastern shore of the San Francisco Bay Alameda County contains the cities of Oakland Berkeley and Fremont among others.

You can also search by state county and ZIP code on. Age gender raceethnicity source of. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes.

Santa Clara County Ca Property Tax Calculator Smartasset

What You Should Know About Santa Clara County Transfer Tax

Bay Area Property Tax Roll Jumps To 1 8 Trillion Ke Andrews

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Special Fund On Santa Clara County Property Tax Bill Pays For Employee Pensions The Mercury News

Understanding California S Property Taxes

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Clara County Ca Property Tax Calculator Smartasset

First Installment Of Santa Clara County S 2019 2020 Property Taxes Due Starting November 1 County Of Santa Clara Mdash Nextdoor Nextdoor